Table of Contents

Running a small business comes with plenty of challenges, and managing payments is often at the top of the list. Between juggling vendors, tracking invoices, and making sure cash flow stays healthy, it’s easy to feel overwhelmed.

That’s where Melio steps in — a payment platform designed to make paying bills and getting paid as simple as possible, without the typical headaches of banking and bookkeeping.

What is Melio?

Melio is a free, easy-to-use bill payment solution that lets you pay vendors and contractors online via bank transfer or credit card — even if your vendors don’t accept cards. It also helps you receive payments from clients faster, directly into your bank account.

The goal? Streamline payment workflows for small businesses, giving you more time to focus on growth instead of paperwork.

Key Features of Melio

Here’s what makes Melio stand out:

1. Pay by Credit Card — Even if Vendors Don’t Accept Cards

One of Melio’s most popular features is the ability to pay vendors with your credit card, while they receive the payment via check or bank transfer. This is a game-changer for extending cash flow and earning credit card rewards.

2. No Subscription Fees

Melio doesn’t charge monthly fees for using its core features. You only pay a 2.9% fee when using a credit card, while ACH bank transfers are completely free.

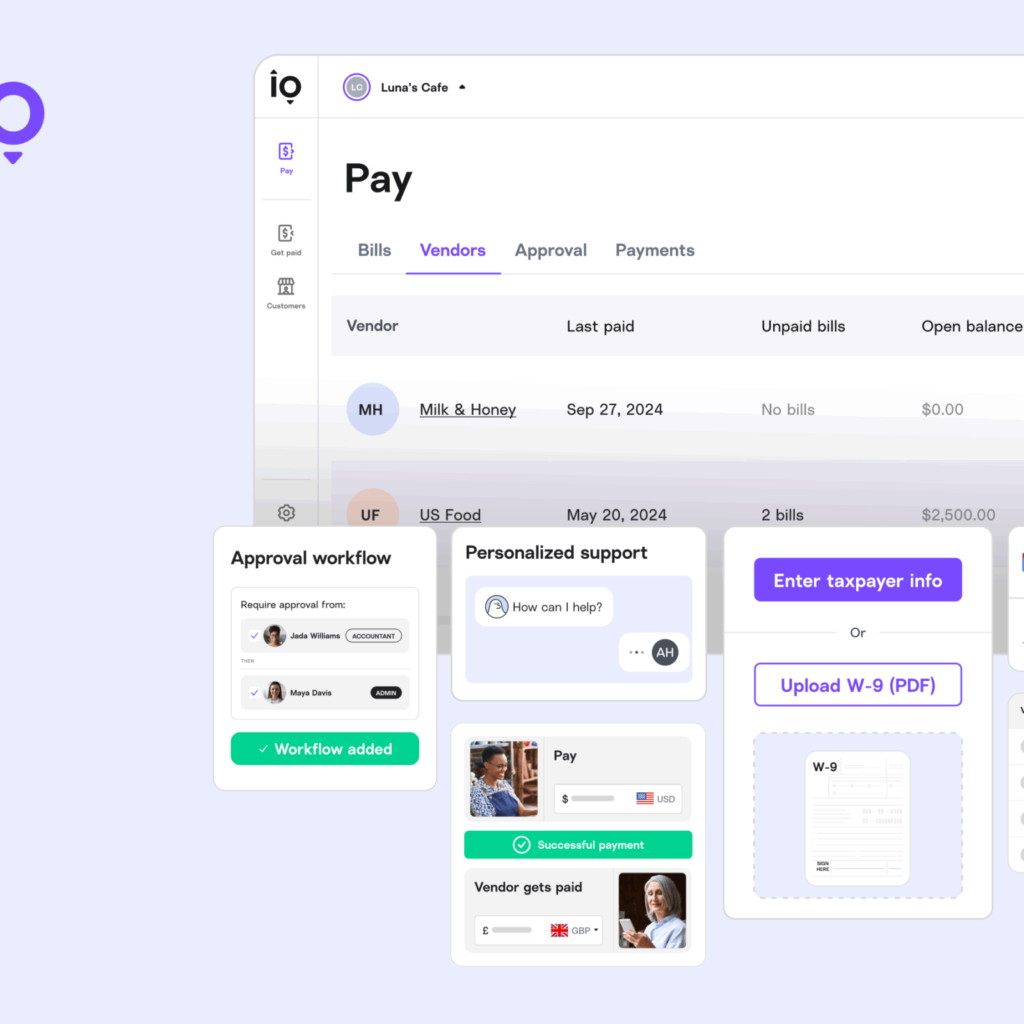

3. Simple Vendor Management

You can store vendor details, set up recurring payments, and track payment history — all from one dashboard.

4. Seamless Integrations

Melio integrates with QuickBooks, making bookkeeping easier and helping keep your records up-to-date automatically.

5. Get Paid Faster

Create custom payment links for your clients, making it effortless for them to send you money online.

Why Small Businesses Love Melio

- Improved Cash Flow – Paying by card lets you hold onto your cash longer.

- Convenience – Pay from anywhere, anytime.

- No Vendor Onboarding – Vendors don’t need to sign up for Melio to get paid.

- Transparent Pricing – No hidden fees; pay only for credit card transactions or same-day transfers.

How Melio Works in Real Life

Let’s say you’re a freelance designer and need to pay your web developer $1,000. They only accept checks, but you want to use your credit card to earn rewards and delay the actual payment from your bank.

With Melio, you:

- Add your vendor details.

- Select your credit card as the payment method.

- Melio charges your card and sends a check directly to your vendor — without them ever having to create an account.

Pricing at a Glance

| Payment Type | Fee | Processing Time |

|---|---|---|

| Bank Transfer (ACH) | Free | 3-5 business days |

| Credit Card Payment | 2.9% | 2-3 business days |

| Same-Day Bank Transfer | $20 flat fee | Same day |

| Check Delivery (Standard) | Free | 5-7 business days |

Who Should Use Melio?

Melio is ideal for:

- Freelancers who want to simplify payments.

- Small business owners managing multiple vendors.

- Accountants looking to streamline client payments.

- E-commerce sellers paying suppliers overseas.

How to Get Started with Melio

Getting started takes just a few minutes:

- Sign up for free on Melio’s website.

- Connect your bank account and/or credit card.

- Add your vendors or clients.

- Start paying or getting paid with just a few clicks.

Final Verdict

If you’re tired of juggling payment methods, worrying about late fees, and struggling to manage your cash flow, Melio is a smart, cost-effective solution. With its no-subscription model, flexible payment options, and seamless integrations, it’s a tool every small business should consider.

👉 Try Melio for free today: Sign Up Here